Resource Libraries > Community Capital Glossary

Community Capital Glossary

Types of Capital

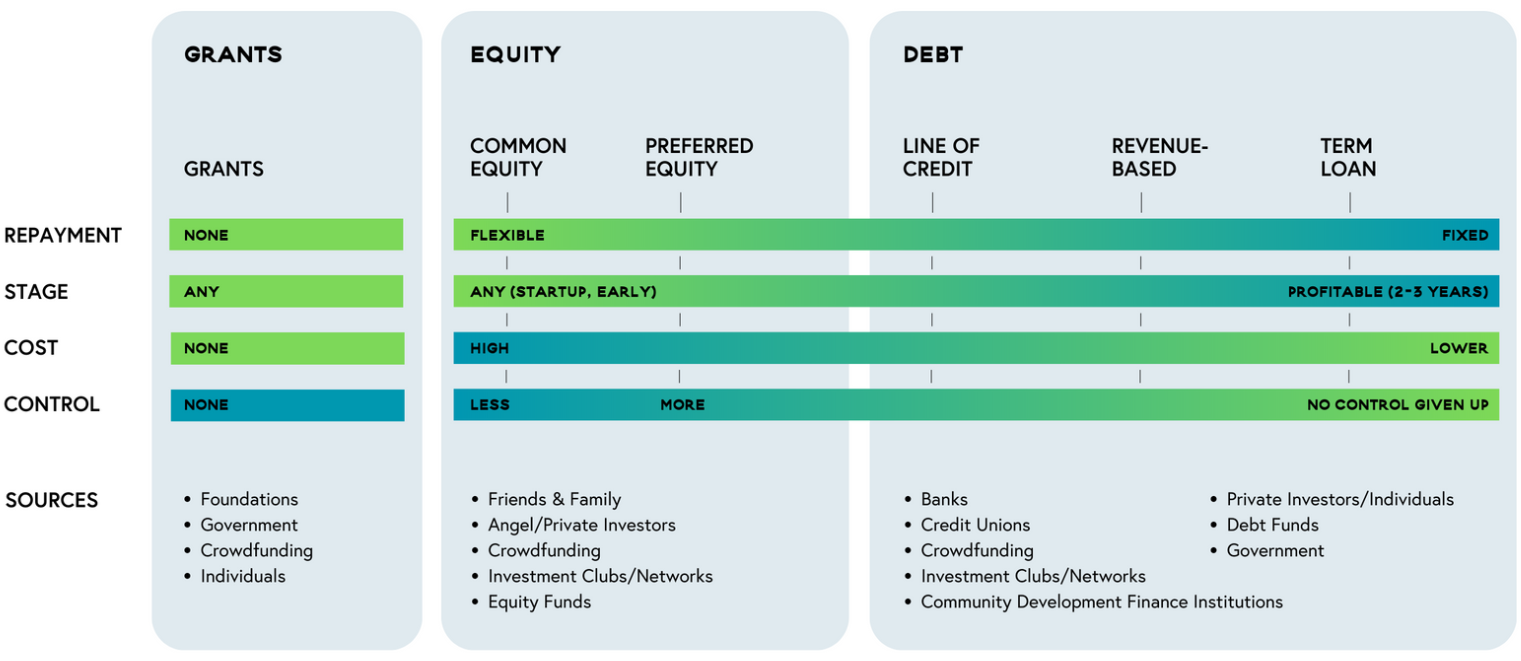

This graphic illustrates, from the business owner’s perspective, the general features of different types of capital along the spectrum of: repayment flexibility, age of the business (stage), cost, and decision-making power (control). Online tools like the Capital Compass from the New Hampshire Community Loan Fund can help businesses decide which type of finance may be more suitable for their particular profile and needs.

Glossary

Types of Capital

-

Debt financing is money borrowed from a lender that has to be paid back over time with interest. Debt financing is generally dependent on the borrower’s ability to make debt payments based on the historical and projected business cash flow.

Pros

Control: The entrepreneur retains control of their company as debt has a temporary relationship. Lenders do not have any say in day-to-day operations of the business.

Loan interest: Loan interest is tax deductible.

Predictability: Loan payments are predictable and are stated in advance, so it is easier to work these into the company's financial projections.

Cons

Credit: The company and the owner must meet credit qualifications in order to be approved for a loan. Even if debt financing is offered, the interest rate may be too high and the payments too steep to be acceptable if a business owner’s credit score is very low.

Collateral: Lenders will generally require that certain company assets be held as collateral. In many cases, the business owner has to personally guarantee the loan.

Fixed payments that affect cash flow: Loan payments must be made regularly which limits how much cash can go back into the business. Also, taking on too much debt makes the business more likely to have problems meeting loan payments if cash flow declines.

-

Equity financing is the act of selling ownership shares of a company in order to finance its growth. Equity investors become partners in the business and only make money if the business succeeds. Equity investors typically look to be paid out by selling their ownership stake in the company at a future date either to the entrepreneur or to another equity investor. This is considered an exit for the investor.

Pros

Cash flow: Equity financing does not take funds out of the business unless there is a dividend.

Long-term relationship: Equity investors do not expect to receive an immediate return on their investment. They have a long-term view and also face the possibility of losing their money if the business fails. An equity investor is a partner in the business and will want to see the business do well. Generally speaking, they can be used as a resource for knowledge and connections when needed.

Credit History: If you have credit problems, equity financing may be the only choice for funds to finance growth.

Cons

Cost: The owner typically has to give up some control of their company when they take on additional investors. Equity partners want to have a voice in making important business decisions, which they can do by exercising their voting rights. Equity investors also typically require a higher return on their investment than a debt investor.

Potential for Conflict: All the partners will not always agree when making decisions. These conflicts can erupt from different visions for the company and disagreements on management styles. It is imperative for entrepreneurs to find equity investors that are aligned with their vision for the company.

-

Money provided by a government agency, foundation, or other organization that does not need to be repaid and does not purchase equity. It is important to understand the terms of a grant before applying. Some grants may have reporting requirements or other additional requirements after the money is received.

Online tools like the Capital Compass from the New Hampshire Community Loan Fund can indicate the suitability of a business for each type of finance.

from The Good Money Guide, published by the Alliance for Community Development

Sources of Capital

-

Angel investors support businesses in their early stages, backing unproven but promising companies with the investor’s own money. They may provide mentorship and advice along with funding for startup founders.

-

A revolving loan fund (RLF) is a financing option that is primarily used to fill in funding gaps for the development and expansion of small businesses. It is a self-replenishing pool of money, utilizing interest and principal payments on old loans to issue new ones. Cities, such as San Diego, offer these loans to their respective city small business owners.

-

Private sector financial institutions that focus primarily on lending and business development efforts in poorer local communities requiring revitalization in the U.S. and that are underserved by the traditional banking sector. CDFIs can receive federal funding through the U.S. Department of the Treasury by completing an application. They can also receive funding from private sector sources such as individuals, corporations, and religious institutions.

-

A credit union is a type of financial cooperative that provides traditional banking services. Credit unions are created, owned, and operated by their participants. As such, they are not-for-profit enterprises that enjoy tax-exempt status. Credit unions have fewer options than traditional banks, but offer clients access to better rates and more ATM locations because they are not publicly traded and only need to make enough money to continue daily operations.

-

Generally speaking, foundations do not make grants to for-profit businesses. Instead, foundations usually provide program-related investments (PRIs) to social enterprises and nonprofits. PRIs are low-interest loans that a foundation can give to organizations or projects that align with the funder’s mission.

-

A fund is a pool of money that is allocated for a specific purpose. An investment fund is an entity created to pool the money of various investors with the goal of investing that money into certain asset classes (equity, loans, real estate, etc.) or sectors in order to generate a return on the invested capital.

Common Financial Terms

-

In the context of a term loan, amortization refers to the process of paying off debt over time in regular installments of interest and principal sufficient to repay the loan in full over the amortization period, which can be longer than the term of the loan. For example, in a 7-year term loan with a 30-year amortization, the borrower makes payments as if the loan was due in 30 years (over a 30-year amortization schedule, which results in a lower payment required), but the full principal balance of the loan is due in 7 years. In many cases, commercial borrowers refinance the loan at this point instead of making a large balloon payment.

-

Bridge financing "bridges" the gap between the time when a company's money is set to run out and when it can expect to receive an infusion of funds later on.

-

An asset that secures a loan or other debt that a lender can take if you don't repay the money you borrow. Examples include real estate, vehicles, inventory, etc.

-

A way to raise funds online by convincing a large number of people to each give money to or invest in a specific project or cause.

-

A percentage of the sum borrowed that is charged by a lender for letting you use its money. A bank or credit union may also pay you an interest rate if you deposit money in certain types of accounts. Can be quoted as a simple percentage or as a base market rate (such as the Prime Rate) plus a margin or additional percentage points.

-

A line of credit (LOC) is a preset borrowing limit that a borrower can draw on at any time that the line of credit is open. Borrowers can draw from the LOC according to their needs and owe interest only on the amount that they draw, not on the entire credit line. In addition, borrowers can adjust their repayment amounts as needed, based on their budget or cash flow. They can repay, for example, the entire outstanding balance all at once or just make the minimum monthly payments.

-

The fee that the lender charges the borrower for making a loan to cover the cost of processing the application, underwriting and funding the loan, and other administrative services. It is usually quoted as a percentage of the loan amount.

-

Providing a personal guarantee means that the individual is personally responsible for the loan if the business (as the borrower) is unable to repay it.

-

Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders. However, preferred stockholders usually have no or limited voting rights in corporate governance.

-

A fee lenders can charge borrowers if they pay off a loan early.

-

In exchange for a loan, the company gives the investor a percentage of sales until the investor has received back principal plus additional interest negotiated with the investor.

-

A loan from a bank for a specific amount that has a specified repayment schedule and a fixed or floating interest rate. The term of a loan (or when the loan “matures”) is the time it takes for all payments to be made by the borrower and received by the lender.

-

The capital of a business which is used in its day-to-day operations.